All markets were constructed with both formal and informal rules, at the same time, the market itself will be governed with certain authority, such as SEC. Mackenzie (2008) emphasize the concept of “the politics of market design” using the example from the new market of carbon emission. The emission trading schemes were also known as the cap and trade system, which is designed to reduce carbon emission and introduce new market mechanism (Carmona et al., 2010). The emission trading schemes allows business to purchase credits from third party if the business exceed its authorized a credit limits for business with the amount of carbon emissions in the given period. Mackenzie (2008) argues the carbon market as “techno-politics”, as the amount of predetermined “cap” played essential role in this system and the transfer of allowances by trading as the core activity in the system exhibited the market behavior similar to investors in the financial market. Or the carbon market does not even exist before the implementation of the system, the policy introduced created the market and shape the market structure in a political way. Researchers argued the carbon markets provided rich ground for political contestation, the conflicts between large corporations and environmental protection organizations consolidated in the carbon markets (Bryant, 2016).

The challenge of climate changes is real but limited actions has been taken over time, the contradictory imperatives from different stakeholder groups on the issue hindered the actual policy to be enforced. Continuing with the European Union Emissions Trading System, which is one of the most prominent existing cap and trade system over the world, it took three attempts on reform of the system including restricting industrial gas offsets, back loading allowance auctions and the 2030 climate and energy package (Carmona et al., 2010). Regardless of the success or failure of the existing cap and trade system in the carbon market, the design of the market certainly concluded political factors, where the formation of the market were based on the ongoing politicization of the climate change. Following this aspect, the carbon market and current trend of electricity cars had boosted the international market for lithium and other minerals.

Moreover, the world mining sectors were also influenced by the growing trend of electricity cars. Australian mining industries has received significant amount of foreign investments for lithium mines and other mineral products, for several companies in China, through the manufacture and sale of electricity cars they have made lump sum of money with government subsidiaries and tax burdens. Thus, the politics of market design could have bigger and deeper impact on the agents in all related markets even it was never predicted before.

Political policies also have impact on the stock performance, IPOs or road shows and the way transactions were conducted. The concept of social trading evolved in the recent year, the concept also emphasized the herding effect in behavior finance. Following experienced or what new investors considered reliable and experienced trader allow new investors to avoid investment loss in the unstable financial market and gain knowledge on trading in a quicker way. However, the practice of social trading relied on the existence of a large, trustable platform and its ability to attract and maintain active traders. The core of social trading is it offers new trader the ability and possibility to copy trade, as the new trader will trade the exact security at the amount as the experienced trade did. Therefore, the social trading platform would have to gain legitimacy and trust from potential users for it to grow.

However, the concept could adopt in a wider range of applications and have wider practices. First off, there are large brokers and well known financial analyst in the market, they could also start to involve in the social trading. From certain aspect, the financial analyst who used to make “buy, hold or sell” suggestions on stocks were already part of the social trading as investors were taking free suggestions on trading from them. The other argument raised by Mackenzie (2008) with “the politics of market design” is the ‘uptick rule’ in the US, as it is more difficult to vote against large corporation than vote in favor for them. Thus, it implies that large corporation would gain advantages in the market against small business and other individuals, following Mackenzie’s argument, if there will be wider adoption of social trading in the market, big corporations could easily gain with potential favorable policies and regulations if they decided to enter into the market.

At the same time, existing large brokers and well known financial analyst would be able to attract more followers with established reputation and influences. In this way, small broker, existing social trading platforms could lose with influences from entrances of large brokers and influential financial specialist into the social trading networks. If policies were introduced to regulate the social trading platforms, existing large brokerage firms and well know professionals in the market could leverage their power on the development of such policy, and limit the access for social trading platforms on amount of daily transactions and challenge the legitimacy of the trading platform. In this way, trading platforms might not be able to continue to operate with current business model, while large brokerage firms would gain through limits applied on the social trading platform.

At current state, there are no specific laws on social trading platforms and the operation of online brokerage in the security market. Existing SEC rules forbids corporation to discuss any information that could be used to predict future stock performance in private meetings. Social trading enabled information transparency among traders in the same online trading community, which allowed information free flow in a small group of traders and shared information also promoted corporative trading. However, the information shared in the trading platform could be used for speculation and insider trade, with the possibility to not disclose the information while simply follows the trade, as social trading offer the possibility to copy and mirror trade in every step. Social trading enabled investors and individual traders to follow experienced trade on each transaction while gain knowledge and experiences with considerably lower costs, portfolio managers and financial advisers would charge higher prices for similar services. Social trading will become competition for traditional brokers, traders and other professionals in the market. However, there are could be future regulations to limit this form of trading or technology could over took the advantages from social trading.

Social trading is also a form of online social networks, which created social ties among all investors involved in social trading on the same platform. Granovetter (1985) coined the concept “embeddedness of markets”, that all the social relations were at the core of economic interactions. In this essence, social trading will also formed a relationship network, which ultimately create a status hierarchy (Podolny, 1993). Therefore, when the relationship network formed in a trading platform, a status hierarchy was developed, in which exercises the “control” on the trading platform (Fligstein, 1996). Competition among traders and other trading platforms could leads to prices competition and create unstable markets, as the market actors could never know the consequences of their behavior (Fligstein, 1996).

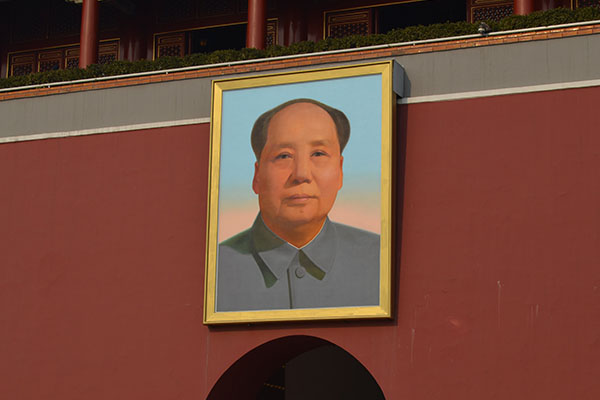

The technology innovation could disrupt existing practice of social trading, with the introduction and implementation of algorithm trading and Artificial intelligence used in financial services has substituted traditional traders, brokers, while customers could create a portfolio through AI’s suggestion just with few clicks. With AI and algorithm, investors could enjoy automated trading, as the trading processes would be completed automatically through computerized programs and assume great investment strategies. There is existing application of AI and algorithm trading in China, where investors can simply subscribe to the services and leave the rest to the algorithm, and AI could perform better than average traders could.

The politics of market design had significant influences on the development of market structure and creation of the status hierarchy in the market actors. Larger adoption of ‘social trading’ could threat small brokers and those who do not follow the trend of technology innovation, social trading benefit individual traders for better information transparency and the possibility to discuss and share information with other traders in the virtual community. However, if policy intervene and create barriers for existing players in the market, the large brokers and professionals still maintain their advantages with established networks and reputations. Social trading could continue to evolve and emerge with AI algorithm, where trading in financial markets could be fully computerized, and investors would be better off with lower price charged fully automated trading programs.

As discussed in Chan (2009) “Invigorating the content in social embeddedness: An ethnography of life insurance transactions in China”, there are strong ties, mid-range ties and weak ties, the strength of the social ties will influence the economic exchange among different parties and the rights and obligations behind the social ties were subject to the social cultural norms. Social ties played important role in all forms of economic interactions and it also facilities market activities among different individuals.

Social trading carries the key features in the financial trading market while also considered as sub category of online social community, where individual interact with each other in the virtue community, the social ties excised in social trading considered weak. The social embeddedness of the markets facilitated all forms of economic interaction in the society (Granovetter, 1985). Social trading integrated the existing information among all investors on the trading platform and gain extra information by compares trading results with other traders on the platform. Social trading resolved information asymmetry among individual investors, prior to social trading individual investors relied on limited amount of available information and technical analysis to make investment decisions on securities. The information asymmetry is one of the reasons, which hindered investors in the market to make rational decisions and incur loss in investments. For social trading, all traders were playing against the market, the social ties among the traders to share idea and information as much as possible, which the share of information also related with the motive to seek extra financial gains. As Burt (1986) discussed that, the formation of social networks stands for resource exchange and dependence. In this case, individual traders formed social ties in exchange for information and improve return on investments, however, the tie is weak as all involved traders seek financial gains from personal interests and most likely have no personal relationship with each other.

Established social ties enabled individual or businesses to gain extra information and access to resources. Chan (2009) discussed the situation where social ties were used in the sales of insurance in China, the researcher found that the insurance agent sales insurance to those clients with strong and mid-range ties, the social ties formed enabled insurance agent complete the sales with one phone call. Social ties also subjects to rights and obligations, the rules or the underlying theory of social ties derived from symbolic interactionism and social exchange theory (Chan, 2009). The operating rules of social ties were categorized with the strength of the ties, relationship properties, and the domain between ethical-affective and instrumental-monetary (Chan, 2009). Whereas the tie that considered strong has a high degree of affection, trust and ethical obligations.

The weak ties or also known as the arm’s-length ties have a high degree of monetary motivations. In the case of buy and sell of life insurances, it is a negotiated direct economic exchange which formed a bilateral agreement to economically benefit both parties in the transaction (Chan, 2009). Buyers and sellers would negotiate in the commercial insurance market with the information transparency, as buyer could shop around in order to negotiate the best term, sellers on the other hand would calculate the profitability with their offering. In contrast to social trading, the reliance on sales agent’s personal social networks is really high in life insurance industry. As discussed above, the social ties involved in social trading are weak, copy trading is similar to an impersonal transactions with immediate exchange of rights and obligations.

In Chan (2009), the research conducted found that sales agent in Chinese life insurance industry initially sale life insurance to close and immediate friends and relatives and gradually turns to clients at arm’s length. Sales agents gain commissions with each life insurance contract they signed, with financial incentives it is considered unethical in Chinese culture for sales agent to continue to focus on the clients group with strong social ties. However, sales agents used scenario and role playing techniques to act as fictive kin, through this strategy sales agents would be able to create a tie with potential clients (Chan, 2009). The ethical considerations were also a part of social cultural elements that shaped the rights and obligations of social ties (Cai, Walking and Yang, 2016). Therefore, while the social ties played relatively minimal role in terms of social trading, it influenced sales agents in life insurance industry in China in multiple aspects, including determine the targeted clients group and how the sales were conducted.

Uzzi (1999) found that a mix of both embedded and arm’s-length ties were the optimal combination of social networks that could form “network complementarity”, through the synthesize of different types of social ties the performance of business operation could reach an optimal and market actors would be able to reduce trading costs through implementation of this strategy. Therefore, the best relations for economic exchanges through the social ties including the following groups, colleagues, distant relative, classmates and neighbors, the strength of the ties are not strong among these group of individual. Therefore, it would be simple economic driven exchanges while there are still trust, affection and obligations in place to avoid fraud and cheating in the process of exchange.

Thus, both parties would expect fair change while the calculation of economic cost can be less precise. Uzzi (1999) also discussed how social relations and networks could be used to reduce the cost for financing. Business could partner with multiple different banks and form an arm’s length relationship, through the relationships business could gain information on loan terms and availability. Uzzi (1999) found business could be able to lower the cost of financing with social ties at arm’s length among banks, Engelberg et al (2010) further elaborated on the study and confirmed that banks would offer loans at lower interest rate and fewer covenants with businesses have social ties with. Social ties are beneficial to business with the ability to facilitate and legitimate information flows, which enabled business to perform better than its peers and monitoring the flow of information. Even through traders involved in social trading also utilized information flow, however, one of the keys in social trading is cooperative analysis of available information, which is different with other market activities when consider the use of information.

Access to information that was not available to wider publics offered advantages to find trading partners at a lower cost, in alignment with previous finding Cohen, Frazzini, and Malloy (2008) confirmed that social networks are often served as an extra information channels, where the information flowed in this channels are often inside information that is not available to the entire market. Moreover, it was found that mutual fund managers with social ties at a public corporation would outperform their peers on the stocks, the reason of superior performance is related with inside information such as corporate news, earnings and etc. Social ties offered inside information created advantages for business and traders in the market, the information flow in the market are usually considered asymmetric with little transparency. Leveraging on social ties usually given advantages for traders and analyst to outperform on the trading of specific stocks, as Cohen, Frazzini and Malloy (2010) revealed that financial analyst would be able to achieve superior performance on the stock recommendations, if they have school ties at senior management team in the business corporation. Hochberg, Ljungqvist, and Lu (2007) conducted studies on the venture capital firms found that wider social networks would improve performance for venture capital firms. Moreover, better social networks of board members would improve the performance of the business.

Larker et al (2010) revealed business with board members at the central of social networks contribute to superior performance on stocks and operation for the business. Social networks and social ties not only improved performance for business on stocks and operations but also allow individuals to get better compensations. Engelberg et al. (2009) revealed that CEOs with greater social connections would receive better compensation, while the executives with fewer social ties tends to get paid less. Most market activities involved social ties required exchange of value, and calculate the economic benefits with the obligations associated with the social ties. In comparison with social trading, there are less economic calculations involved with social trading, as all traders are playing against market in order to maximized its own return.

Social ties given leverages for businesses and individuals to gain better terms in the economic exchange, for most market activities, social ties offered new information channel and improved information transparency, which could translate to lower financing costs, better performances or opportunities to exploit.

Leave A Comment